In the same way, some European countries are deploying their national hydrogen strategies and roadmaps (Portugal, Austria, Italy, Belgium, France, Germany, the Netherlands, etc.).

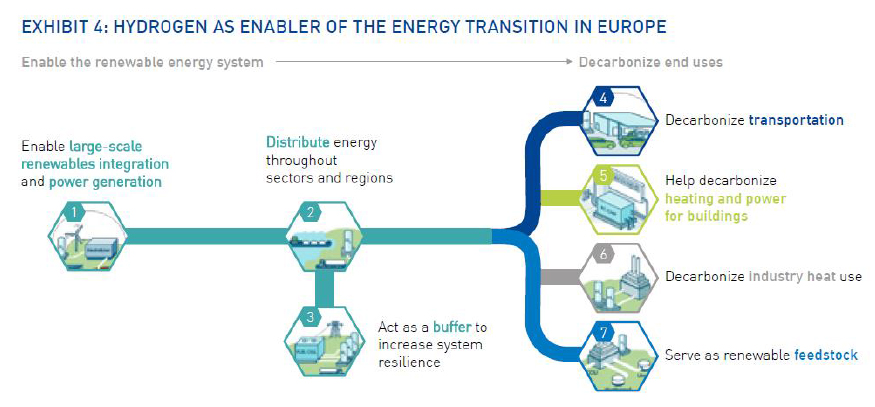

For example, the aim is to lead the way in green hydrogen production technology, which is produced by electrolysis using renewable energies. There is, also, special interest on blue hydrogen, which is obtained by reforming hydrocarbons and with CO2 capture. It is made, aswell, a commitment to heavy land transport and the integration of renewables. And it is declared that hydrogen will be key as a storage system.

Italy aims to position itself as a hydrogen HUB. And in the current call for the Horizon 2020 Green Deal, one can guess the areas in which Germany and the Netherlands would have a prominent presence. In fact, at the end of 2018 Germany approved the second phase of the National Innovation Program in Hydrogen and Fuel Cell Technologies for another ten years with 1.4 billion euro in funding, including subsidies for hydrogen service stations, fuel cell vehicles and micro-cogeneration purchases, funding that will be complemented by two billion euro in private investment.

The hydrogen-related IPCEI- Important Projects of Common European Interest should not be forgotten either.

These actions must cover some industrial aspect of the hydrogen value chain and call for collaboration between companies and countries. Their objective is to develop products and services for a competitive industrial offer with the deployment of hydrogen uses and/or the associated infrastructure.

The scope should address the stages following the pilot line, including the experimental or test stage, but not mass production. These are projects with a significant innovative character and large scale where the benefits should not be limited to the companies or the sector directly concerned. In other words, these projects must have an impact on other sectors and markets.

In Spain, the Ministry for Ecological Transition within the framework of the Integrated National Energy and Climate Plan 2021-2030 (PNIEC) has launched the "Renewable Hydrogen Roadmap" for consultation and identifies this vector as a key to achieving climate neutrality.

At the level of the Basque Country, the Department of Economic Development of the Basque Government, through the Basque Energy Agency, is developing the strategy in this area.

Iberdrola, on its part, has launched an ambitious project in Puertollano for the production of 400t/year of green H2. Iberdrola is considering a mixed scenario with battery-based electromobility and hydrogen as an alternative for heavy and long-distance transport.

In CIC energiGUNE, as part of our commitment to sustainability, we are working in the field of hydrogen.

At the center we research hydrogen production by thermochemical means from water and heat. The ultimate goal is to produce hydrogen with high performance and acceptable costs.

For the generation of these reactions, the use of abundant industrial waste is sought, which contributes to the circularity of the economy. In addition, research is focused on reactions at low working temperatures, which would result in a great diversity of usable heat sources. This opens the door to the conversion of waste heat from many industries into a clean, high-energy fuel.

Recently, the International Energy Agency made an analysis of the lessons learned from the 2008 crisis and the parallel with the COVID-19 crisis. In this analysis, the IEA argued that the countries and companies that came out stronger in the 2008 crisis were those that bet on renewables.

Establishing this parallelism, the IEA recommends hydrogen and energy storage to emerge stronger from the COVID-19 crisis. And there is no doubt that they will be triggers for the exit from the crisis and for the energy transition.